Child Care Subsidy 2024/25

Effective from the 8th July 2024.

The Federal Government’s Child Care Subsidy (CCS) offers families access to fee reduction for a vital and much-needed service and is simpler than the older multi-payment plans. The new means tested subsidy has replaced Child Care Benefit (CCB) and Child Care Rebate (CCR).

How does it work?

Subsidies will be paid directly to SOEL and we pass them on to families in the form of fee reductions. Families will then pay the difference between their subsidy and the fees charged.

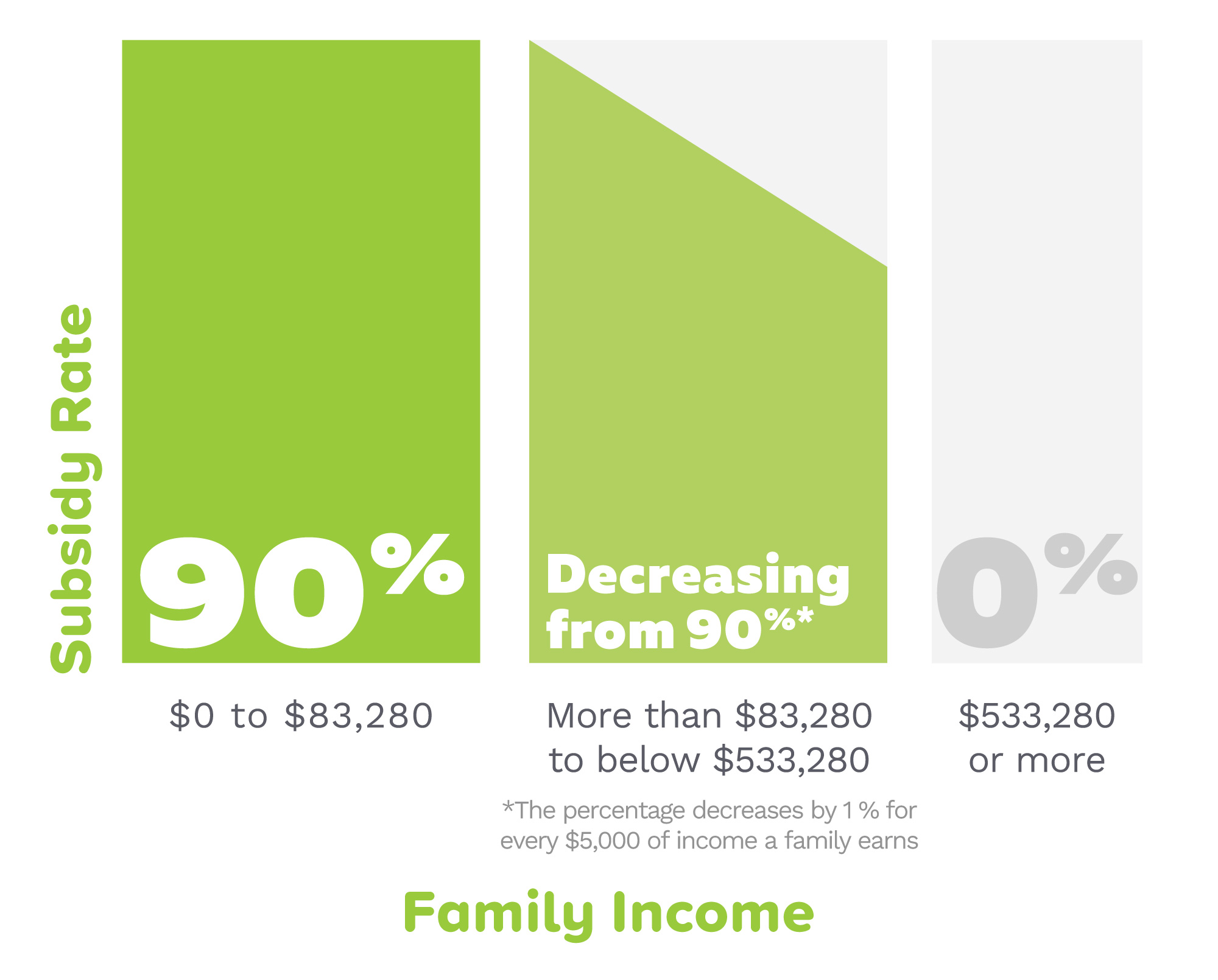

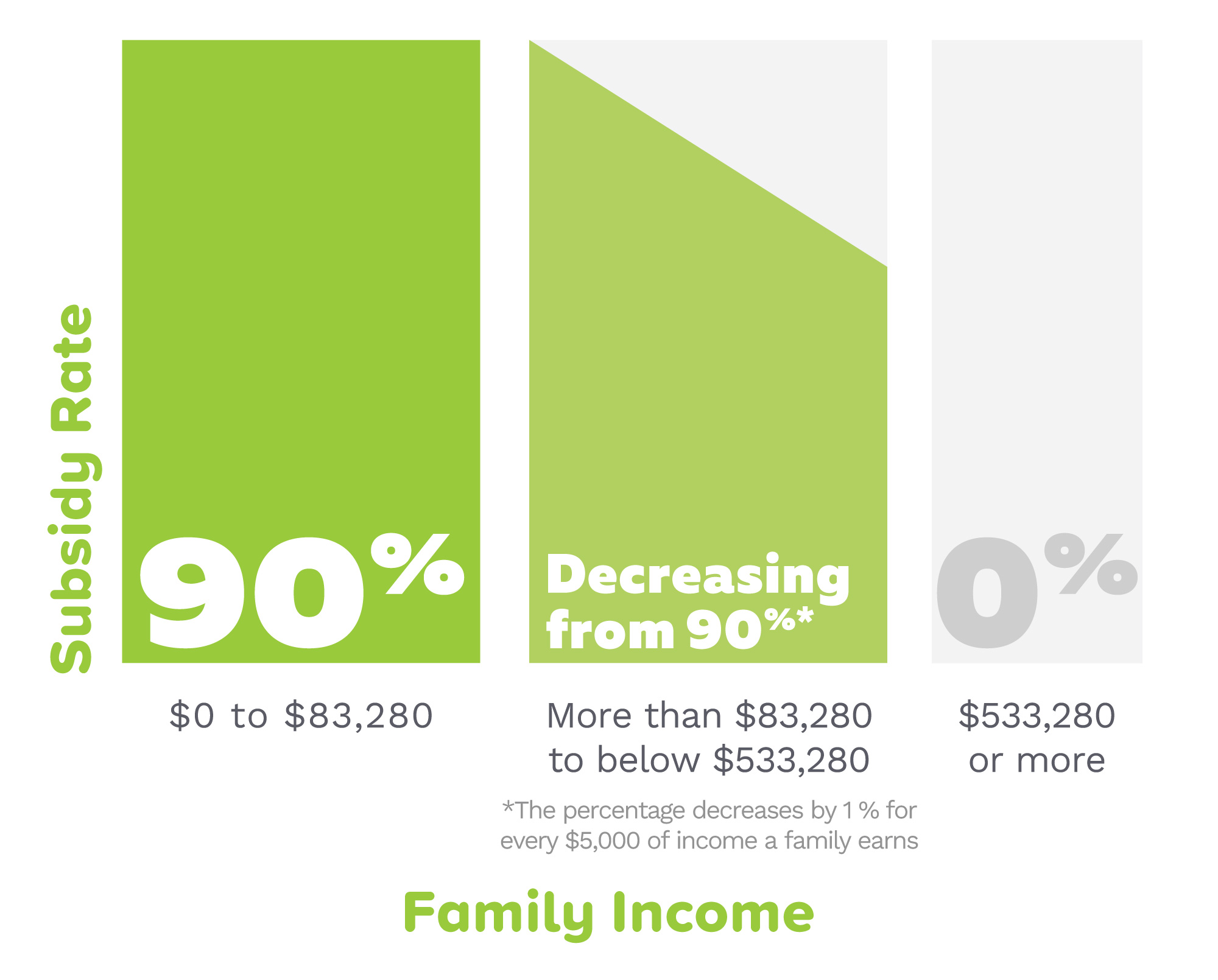

1. Combined Family Income

A family’s annual taxable income will determine the percentage of CCS they are eligible for. It is important to note that just like the the old system of CCB and CCR (Child Care Benefit and Child Care Rebate), there will always be a gap between the amount of subsidy available and the fees charged by any child care provider, and that the rate of CCS will also remain the same.

Rates for second and younger children from 8th July 2024

| Family Income | Second and younger children subsidy rate |

|---|---|

| $0 to $141,321 | 95% |

| More than $141,321 to below $186,321 | Decreasing from 95%. The percentage decreases by 1% for every $3,000 of income a family earns. |

| $186,321 to below $265,611 | 80% |

| $265,611 to below $355,611 | Decreasing from 80%. The percentage decreases by 1% for every $3,000 of income a family earns. |

| $355,611 to below $365,611 | 50% |

| $365,611 or more | Higher CCS rates no longer apply, all children in the family will receive the standard CCS rate. |

Children and families must meet the criteria below:

- Children must be aged 13 or under, not attending secondary school, and meet immunisation requirements.

- The person claiming the Child Care Subsidy (or their partner) must meet residency requirements and also satisfy the Child Care Subsidy activity test.

- Childcare services must also be provided by an approved provider in Australia and not be part of a compulsory education program.

2. Activity level of parents

The number of hours of subsidised care families can access, will be determined by an activity test. The higher the level of activity, the more hours of subsidised care families can access, up to a maximum of 100 hours per fortnight.

- Paid work (including leave, such as maternity leave)

- Study and training

- Unpaid work in family business

- Looking for work

- Volunteering

- Self-employment

- Other activities on a case-by-case basis

However, some of these activities will only be recognised for a certain amount of time. The government will only count:

- Periods of unpaid leave for up to 6 months – this doesn’t apply to unpaid parental leave

- Setting up a business for 6 months out of every 12 months

There will be exemptions for parents who legitimately cannot meet the activity test requirements, as well as to support children’s participation in preschool.

Hours of Activity Per Fortnight eligible for Child Care Subsidy

The parent or guardian with the lowest hours of activity per fortnight will determine the hours of subsidised care. The hours of subsidy per child, per fortnight are:

| Hours of Activity | Hours of Subsidy |

|---|---|

| Less than 8 hours | 0 hours if you earn above $83,820 24 hours if you earn $83,820 or below |

| 8 to 16 hours | 36 hours |

| 16 to 48 hours | 72 hours |

| Over 48 hours | 100 hours |

Parents whose hours of paid work vary from one fortnight to the next (such as casual workers) can estimate their fortnightly hours of work based on a three-month period.

Families with Aboriginal and/or Torres Strait Islander children can get at least 36 hours of subsidised care per fortnight for that child. This is regardless of their family’s activity level.

How does the activity test work?

The table above indicates how many hours of subsidy you will receive per hour of activity per fortnight. Families earning a combine income of $533,280^ or more are not eligible for any subsidy.

The great news is that a broad range of activities will meet the activity test requirements, including paid work, being self employed, or doing unpaid work in a family business. If you’re looking for work or volunteering or studying, you’ll still be able to satisfy the activity test. Importantly, those who genuinely cannot meet some eligibility requirements may be eligible for exemptions.

For the first time, activities such as studying, and volunteering also work in your favour towards your child care subsidy. Taking some extra time to follow your interests or develop some new skills, even from your home through online learning platforms like TAFE and university courses, will count as activity hours towards your subsidy. This is another way that CCS differs from the old Child Care Benefit and Child Care Rebate system.

3. Type of Child Care Service

An hourly rate cap will be calculated depending on the type of approved child care you use:

| Type of Child Care | Hourly Rate Cap |

|---|---|

| Centre Based Day Care | $14.29^ |

| Family Day Care | $13.24 |

| Outside School Hours Care – Before, After and Vacation Care | $14.29 |

^ Indexed each financial year.

A school-aged child is one who is either:

- In school (including home-schooled children)

- 6 or older – The hourly rate cap for WA is $12.51.

To access all the information that you’ll need to estimate your fees on the calculator, call our enrolments team on 6314 1199.